🌍 What are Free Industrial Zones?

The Free Industrial Zone (FIZ) is one of the specific types of Special Economic Zone (SEZ). These free zones are governed by special legislation that grants greater economic freedom compared to other territories in the country. Companies belonging to these Special Economic Zones enjoy a series of tax and commercial benefits.

These types of economic areas are found in many parts of the world, starting from the USA and China, to Spain. Generally, the objective of this type of territories is to attract Foreign Direct Investment, boost the industrial fabric and increase the competitiveness of the national economy.

🇬🇪 Free Zones in Georgia

Georgian free economic zones are governed by the Law of Georgia on Free Industrial Zones of 2007. The initiative on the part of the government to create these economic areas has arisen from the perspective of growth, especially with the aim of attracting foreign capital and increasing the countrys technological advances.

Companies can enjoy the following advantages:

- Tax incentives;

- Simplified bureaucracy;

- Availability of multiple currencies (possibility of using any currency);

- Exemption from most licenses and permits;

- Independence from local authorities.

💵 Tax benefits of Free Industrial Zones in Georgia

One of the attractions of being part of the free zones is their taxation. Free zone company in Georgia can reduce tax burden to almost zero. This makes it possible to increase competitiveness and drastically reduce company costs.

These tax benefits are as follows:

- Companies are exempt from paying corporate income tax;

- Dividends and interest are not taxed and are not included in the recipients taxable income;

- Trade between companies in the free trade zones is exempt from VAT;

- Companies are not required to administer the withholding taxes of their employees;

- Exports are exempt from VAT;

- Imports are exempt from import tax;

- Real estate, including land located in the industrial park, is not subject to property tax;

- Trade between enterprises belonging to free zones and other Georgian enterprises is taxed at 4%.

📊 Other advantages of free zones in Georgia

In addition to tax benefits, these special zones in Georgia also offer operational advantages. These advantages make it more attractive and profitable to do business in Georgia and to obtain a license from one of Georgian Free Zones.

We can highlight the following operational advantages:

- Modern infrastructure;

- Low rents;

- Right to obtain certificate of national origin product;

- Simple business structure;

- Very fast solutions;

- Availability of very powerful power grid;

- Low electricity rates;

- Zones with skilled labor;

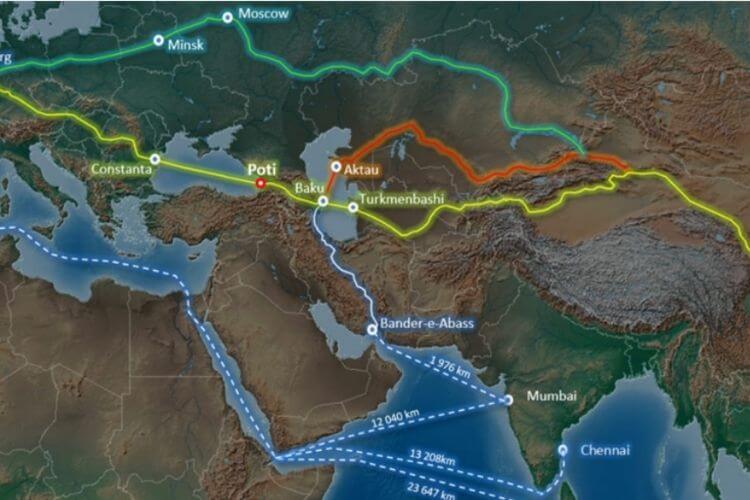

- Strategic area in terms of logistics;

- Reduced and simplified licensing and settlement costs;

- Low costs for goods and communication services;

- Management services for companies;

- Good geostrategic position, as Georgia is located between Eastern Europe and Western Asia. In other words, the Caucasus country is a link between Europe and Asia, which is very beneficial for many companies;

- Developing country with prospects for further growth.

💼 Permitted legal forms

There are different types of legal personality under which a company can be registered in Georgia and which can be part of one of Georgias free industrial zones. These are:

- Self-employed;

- Limited liability company;

- Joint stock company;

- General partnership;

- Limited partnership;

- Cooperative;

📑 Free zone licenses

These are the licenses that can be applied for in the free industrial zones:

- General manufacturing license;

- General commercial license;

- Special commercial license (restricted to certain types of activities);

- Production of IT products/ IT service license;

- Consulting;

- General service license;

- Financial service license (incl. Banking);

- Warehousing license;

- Logistics company license.

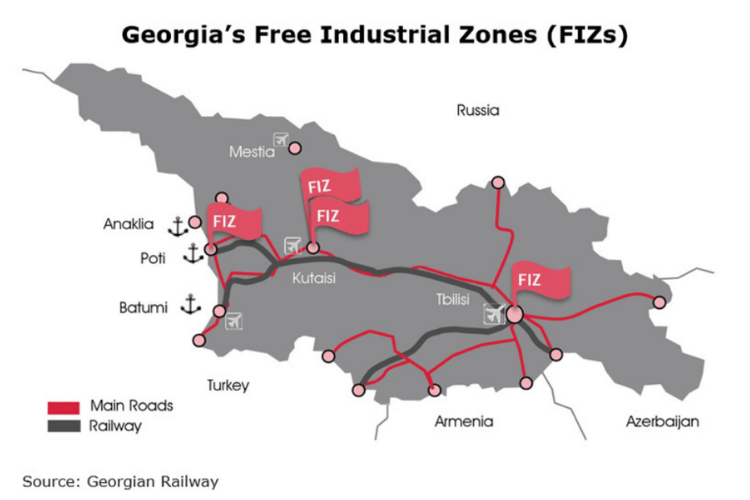

📍 Which Free Industrial Zones (FIZ) exist in Georgia?

In Georgia there are 4 Industrial Free Zones (FIZ): one in Tbilisi, the capital of Georgia, one in Poti, which has access to Black Sea, and two in Kutaisi.

Tbilisi Free Zone (TFZ)

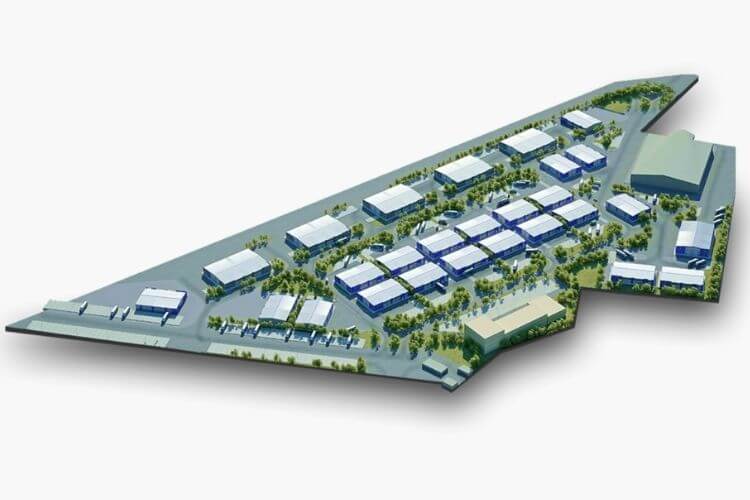

Tbilisi Free Zone (TFZ) occupies 17 hectares of land and is divided into 28 individual plots. It has direct access to the most skilled and competitive labor force in Georgia, and is close to the city center (17km), the international airport (30km), and the main freight road.

The smallest plot of land is 2,000 m2, and can be leased individually or collectively for up to 50 years. Its unique configuration gives you the opportunity to merge several plots without restricting road access and communications.

Poti Free Industrial Zone (Poti FIZ)

Poti Free Industrial Zone LLC is owned by CEFC Eurasia (75%), the Government of Georgia, Ministry of Economy (10%) and RAKIA (Government Agency of the Emirate of Ras Al Khaimah Investment Authority) of the United Arab Emirates (15%).

It covers about 300 hectares, started operations in 2010 and has since been tailored to companies and investors from various segments. Most of the land is offered for industrial and logistics activities, from light manufacturing to heavy industries, such as chemical, steel and processing.

Being adjacent to the seaport of Poti, one of the most important on the Black Sea, it also offers direct and uninterrupted access to regional and international rail networks.

For all its advantages, a tax-free environment and a fast and easy business set-up process, Poti FIZ has become the most sought-after FIZ facility in the region.

Kutaisi Free Industrial Zone (Kutaisi FIZ)

This free zone has been operating in Gerogia since 2009. The zone is located only 10 km from Kutaisi international airport, 95 km from Poti seaport and 210 km from the highway connecting to Tbilisi.

This location aims to become an important industrial and commercial center, the junction between the Black and Caspian Seas, thanks to its convenient naval, air and land infrastructure.

The 27-hectare plot is located on the territory of the famous Kutaisi automobile plant. Its 128,000 m2 of land is occupied by industrial, administrative and storage facilities.

Hualing Free Industrial Zone of Kutaisi (Hualing FIZ)

The Hualing Kutaisi Free Industrial Zone covers a territory of 36 hectares. It is located in the city of Kutaisi, the second most populated city in Georgia.

Considering the proximity to the Kutaisi International Airport (19 km), the Port of Poti (95 km) and the highway connecting to the capital Tbilisi (210 km), the Hualing Kutaisi Free Industrial Zone represents an important hub within the country.

Thanks to connections with railroads, roads, ports and airports, Hualing Kutaisi acts as an industrial and commercial center within the Black Sea and Caspian Sea region.

To sum up, Free Zones are useful spaces for any kind of product and service oriented company that operates at an international level.

Free Zones help companies to obtain competitive advantages that lead them to more wealth and earnings. If you want to know more details about the company registration in Georgia and obtaining licenses of free zones, contact us and we will help you.